Market Insight from

Fakeaways: a new homecooking trend

Intermittent lockdowns have seen a rise of the ‘fakeaway’, as consumers experiment more with home-cooking, according to GlobalData.

The Covid-19 pandemic has forced places of work, transport, and retail to close down during various lockdown periods. Restaurants and takeaways have adapted to the situation by offering more collection and delivery services for consumers, which consumers have eagerly responded to, with reported increases in delivery orders being placed before the first lockdowns were introduced in spring.

However, as the pandemic continued and more people found themselves staying at home, the overall proportion of home-cooked meals has risen; GlobalData’s Covid-19 surveys indicate that consumers are increasingly spending more time at home cooking food as a result of the virus, and this trend is set to become concrete behaviours for much of the population in the coming years.

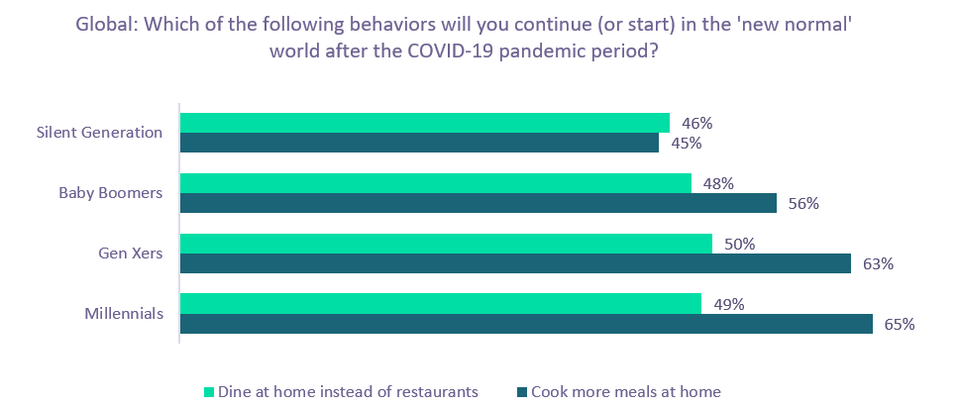

According to GlobalData, nearly two-thirds (61%) of the global population plan to continue to cook more meals at home even after the pandemic.

Notably, this is most prominent among younger generations, such as millennials; the overall slowdown in lifestyles that many from this age group have been forced to experience has led them to reassess their dining priorities and turn to home-cooked meals as both a means of utilising their free time and ensuring a healthier, more balanced diet.

That said, the lockdowns introduced to counter the pandemic have increased the number of consumption occasions for home cooking across all generations; consumers who are health and price-conscious are aware of the risks of fast food and the benefits of home-cooked meals.

The rise of home cooking has also seen an increase of ‘fakeaway’ recipes; popular takeaway meals that consumers are now attempting to prepare at home. During lockdown periods, where foodservice operators’ reach was limited, many actively promoted their traditional recipes on social media platforms. This is partly a publicity act of goodwill but also ensures that their consumers don’t forget about these restaurants and fast-food chains while stuck at home.

However, the ability to replicate the same flavour and indulgence factor on a cheaper and healthier method could pose an obstacle to takeaway delivery channels in the long-term. Restaurants are able to capitalise on an ‘experience-factor’, leveraging unique and luxury atmospheres that are difficult to replicate at home, whereas delivery-only platforms tend to rely on convenience and affordability as their key selling points. If consumers find cheap and easy ways to replicate this at home, traditional takeaways will lose out – leveraging healthier positioning, secret ‘specialised’ recipes and highlighting trending ingredients will help these operators stay relevant.

Although the pandemic continues to affect consumer habits, the lockdown periods have supported the rise of home cooking and have inspired consumers to try more recipes than before; and these habits will survive beyond the pandemic.

For the latest food insights, visit GlobalData's Consumer Intelligence Centre.